Federal Budget 2023-2024

On Tuesday 9th May the Australian public received the 2023-2024 Federal Budget.

The overall economic outlook was an improvement in the cash balance and net business debt resulting in a $4 billion surplus. In addition, Treasury is forecasting the economy to slow over the coming 2 years.

Please read on below for key takeaways on the budget initiatives and, as always, our consultants are here to help, so reach out to us to have a conversation about how the budget initiatives can fit in to your circumstances and financial goals.

Individuals

Concessional superannuation rate - From the 2026 financial year the tax rate applied to future earnings for balances above $3 million will be 30% (up from 15%)

Super Guarantee payments – from 1 July 2026 employers will be required to pay their employees SG entitlements at the same time as their salary and wages

Cost of living measures – a numbers of measures introduced including energy bill relief for eligible households, increase to childcare subsidies, increase to payments received by single principal carers and recipients of working age payments

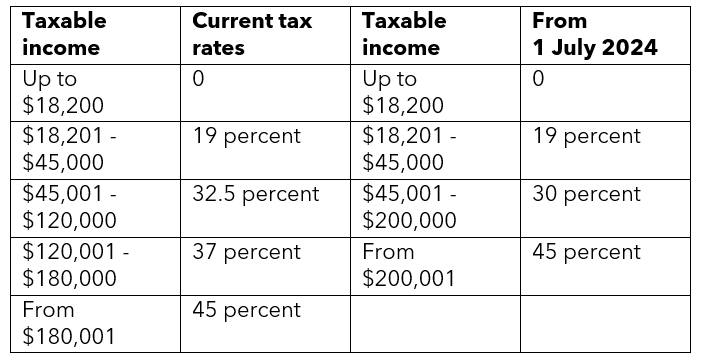

Personal income tax rates – this year’s budget has confirmed the stage 3 tax cuts from 1 July 2024 representing a tax saving of up to $9,075 per person:

Business

Build-to-rent developments – for eligible new projects where construction commences after 9.5.23 the rate of capital works deduction increases from 2.5% to 4%.

Super Guarantee payments – from 1 July 2026 employers will be required to pay their employees SG entitlements at the same time as their salary and wages

Instant asset write-off – This is reduced (from unlimited write offs in the previous 2 years) to only $20,000 per asset in FY24 and limited to businesses with less than $10m turnover

Energy Incentive – additional 20% depreciation deduction for assets supporting efficient energy use for businesses below $50m turnover, capped at $100k ($20k deduction, average $7k tax saving)

FBT Exemption – continuation of the FBT exemption for eligible plug-in hybrid cars up to 31 March 2025